Silver Lining in the Rising Sun

- Mar 24, 2011

- 3 min read

By Griffin W. Huschke, Mayme and Herb Frank Research Fellow

A number of storylines have emerged from the wake of the 8.9 magnitude earthquake and subsequent tsunami that struck the northern coast of Japan last week. The newfound aversion to nuclear energy has potentially huge ramifications for low-carbon energy plans, and there are a host of multilateral organizations working to alleviate suffering in the hardest hit areas. But in trying to come up with blog posts on these topics, it was almost impossible to get past the magnitude of human tragedy that has gripped that country. A piece in the New York Times describes the town of Rikuzentakata, in which one in ten of its 23,000 inhabitants are dead or missing. The entire high school swim team is gone–no one has seen the swimmers since the earthquake almost two weeks ago. Stories such as this are only too common in the aftermath of the earthquakes and tsunami that rocked the north coast of Japan. This is a tragedy of almost unspeakable proportions.

But in trying to focus on some good to come out of this story, we turn our attention to the quick action of the G7 last week, which took measures to weaken the Yen relative to other major global currencies. Japan is going to need a lot of cash on hand to rebuild (the Japanese government estimates it’s going to take $309 billion to get everything back into shape), which means that the Japanese government is going to have some extra-stuffed treasuries in the next couple of years (SPOILER ALERT: THERE’S ECON COMING UP). For ForeX traders, that means there’s going to be more scarcity of Yen (the Japanese government has all of the Yen!), which means Japan’s currency will be worth more. So in responding to market incentives, investors all over the world scrambled to buy up Yen, which hit an all-time high relative to the dollar.

That’s great if you’re a pensioner, because your monthly check stays the same while imported stuff cost less. But for everyone else in Japan, a strong Yen would cause the economy to tank. Companies like Toyota, Sony, and Hitachi rely on exporting goods and services abroad, and their revenues serve as the lifeblood of the Japanese economy. When the Yen is strong, these companies have a lot harder time competing with other cheaper firms, as customers choose the least expensive options. This lowers these companies’ revenues and depresses the Japanese economy as a whole. So, in order to stabilize Japan’s fragile recovery, the G7 pumped a lot of Yen into the global economy, lowering the scarcity of the Yen, and making it less powerful relative to major currencies (END ECON SPOILER).

What’s remarkable about the G7’s actions over the last week isn’t their economics, but their alacrity. Multilateral institutions get a bad rep for responding slowly to disasters and having their actions watered down by various interest groups and consensus voting (think the UN mission to Rwanda). The G7 beat those expectations twofold: not only did the finance ministers of the seven largest economies act in concert within a week of the disaster, but they acted in an effective manner that, at least for now, is working. They also worked to allay fears over future currency appreciation like a boss, and committed to intervene again if the Yen gets stronger down the road–all in less than two weeks after the disaster. In the words of our era’s Tennysons, the G7 is so fly, it should be called the G6.

The fact is that multilateral institutions can be just as dynamic as domestic parliaments. There will always be issues that are more controversial than others, which will naturally require more deliberation. But in clear-cut cases of need, like Japan, multilateral institutions have shown they can step in and do the right thing. Maybe it’s time they get a new rep.

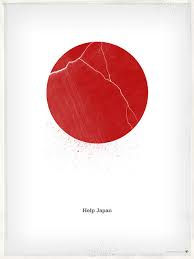

Please give: to provide relief to Japanese survivors, you can donate to the International Red Cross at their website, or text REDCROSS to 90999 to instantly donate $10.

Japan has been one of the greatest international contributors to international relief efforts around the world. Please help give a little bit back.

Comments